Insurance Companies Determine Risk Exposure by Which of the Following

Your age plays a factor because as we get older our likelihood of dying increases. The right-hand side focuses on speculative risk.

What Is Risk Exposure Definition From Searchcompliance

When you buy commercial insurance you pay premiums to your insurance company.

. Mathematics of Risk Introduction There are many mechanisms that individuals and organizations use to protect themselves against the risk of financial loss. These elements are due to. People with higher loss exposure have the tendency to purchase insurance more often than those at average risk.

Risk professionals find this distinction useful to differentiate between types of risk. They decide how much coverage the client should receive how much they should pay for it or whether to even accept the risk and insure them. Each insurance company has its own proprietary formula to help determine its risk or exposure which results in your premium.

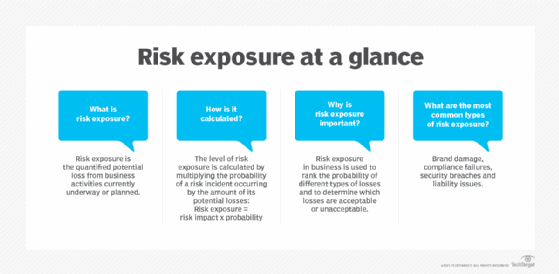

Some risks can be transferred to a third partylike an insurance company. Homogeneous exposure units are similar objects of insurance that are exposed to the same group of perils. Risk exposure is usually calculated by multiplying the probability of an incident occurring by its potential losses.

The basic unit that underlies an insurance premium. These third parties can provide a useful risk management solution. Peril 风险 is something that can cause a financial loss such as an earthquake or tornado.

In business risk exposure is often used to rank the probability of different types. Special acceptance requires the creation of a separate agreement between the ceding. These include a wide range of losses including those from fire theft or lawsuits.

Most insurance providers only cover pure risks or those risks that embody most or all of the main elements of insurable risk. Perils can also be referred to as the accident itself. Most of this actuarial information is complex proprietary and not generally available to the public.

Adverse selection is the tendency of persons with higher loss exposure to purchase insurance more often than those at average risk. The left-hand side represents pure risk. Your basic profile your history and your lifestyle.

Risk exposure is a measure of possible future loss or losses which may result from an activity or occurrence. Risk exposure is a quantified loss potential of business. The exposure units actually exposed to loss in a given period.

To calculate risk exposure analysts use this equation. The risk impact is the cost to the project if the risk actually materializes. Insurers pool risks by accepting a large number of policyholders that have a low risk of incurring losses.

The exposure units actually exposed to loss at a given point in time. Loss is the unintentional decrease in the value of an asset due to a peril. The actuaries at large insurers use complicated risk models and many factors to determine exposure.

Insurance underwriters evaluate the risk and exposures of the prospective clients. Most of these formulas though are some variation of what is known as the pure premium method. Probably the most important step in the risk management process is the identification or finding of.

Probability that the risk will materialize. So properties with high risk have higher property insurance rates crime weather etc and low risk properties cost much less to insure. Probability of risk occurring X total loss of risk occurrence risk exposure.

Hazards Which of these are considered to be events or conditions that increase the chances of an insureds loss. Risk pooling and the law of large numbers. Insurance agents must be licensed in order to sell insurance products.

Read about how WhiteHat Security Index can track data to measure your risk exposure overtime. Risk Management Identifying your Loss Exposure. Hazards are events or conditions that increase the likelihood of an insureds loss.

With that said I can still. In return the company agrees to pay you in the event you suffer a covered loss. The extension of coverage for a peril that is not generally covered in a reinsurance treaty.

While it would be impossible to name every single risk factor that life insurance companies consider weve grouped the most popular ones into three major buckets. Insurance companies determine risk exposure by which of the following. Usually insurance premiums for business properties are set by multiplying the value of the building and its contents by a value that the insurance company comes up with suitable level of risk.

Risk is defined as the potential for loss. Insurance companies usually look at four different types of exposures in their policies. Risk Exposure Risk Impact X Probability.

Government organizations and public and private companies provide various forms of protection including insurance contracts such as homeowners auto health and. These different formulas are why results vary widely when you receive quotes from multiple insurance companies. Risk exposure is the product of these two terms.

That needs to be charged to insure that risk. The probability is the likelihood that it will materialize. Check all that apply.

What is an insurable risk. Underwriting involves measuring risk exposure and determining the. Insurers make money by taking advantage of two statistical concepts.

Insurable risks are risks that insurance companies will cover. Different insurance companies will have their own ways of calculating risk exposures and it will vary for different types of insurance. The risk-based capital ratio is used to identify insurance companies with high risk exposure and force them to hold a high level of capita If an Insurance company becomes insolvent a federal emergency fund is used to pay outstanding claims.

When an insurer issues an insurance contract it agrees to assume the risks described in the policy in exchange for a premium. Risk Exposure is comprised of two independent variables. A loss exposure is a possibility of loss it is more specifically the possibility of financial loss that a particular entity or organization faces as a result of a particular peril striking a particular thing that you have assigned value to.

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

Determining Risk And The Risk Pyramid

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

Determining Risk And The Risk Pyramid

Precautions And Safety Measures In The Workplace Workplace Workplace Safety Fire Risk Assessment

Comments

Post a Comment